What is the effect of a monetary policy shock if models differ in structure, estimation and data vintage?

Why is it interesting?

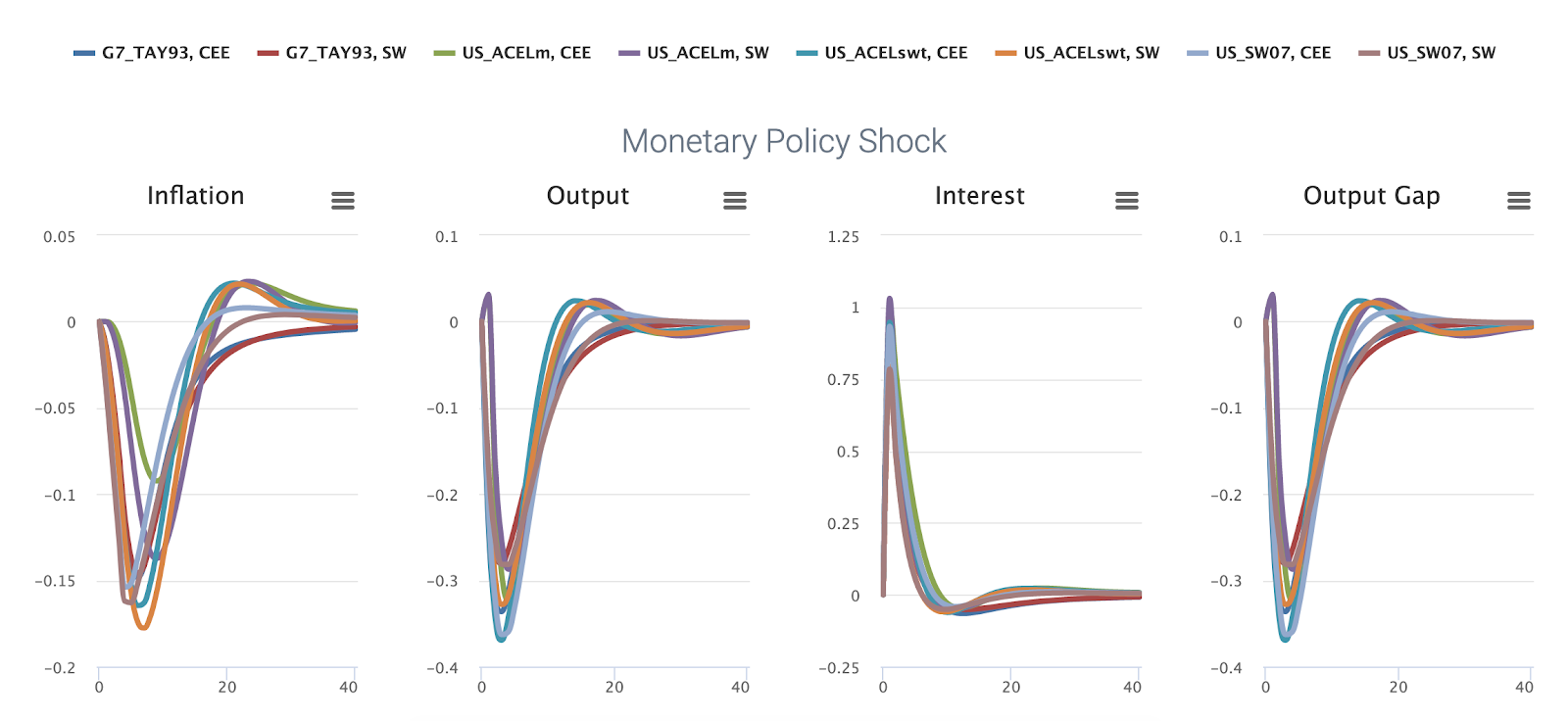

This exercise aims to compare the second generation DSGE models (US_SW07, US_ACELm, US_ACELswt) and the model in G7_TAY93, as these models differ in terms of economic structure and parameter estimates, which are based on U.S. data.

What to do on the MMB?

What is interesting?

Surprisingly, the effect of the policy shock on real output and inflation given a common policy rule is very similar in the four models. The quantitative implications for real output in G7_TAY93 and US_SW07 are also almost identical. The outcome under US_ACELm initially differs slightly from the other two models. In the period of the shock we observe a tiny increase in output, while inflation does not react at all. From the second period onwards output declines to the same extent as in the other two models but the profile is shifted roughly one period into the future. The decline in inflation is similarly delayed. Once we implement US_ACEL with the SW assumptions (US_ACELswt (2011)) of no timing constraint on policy and no cost channel, the output and inflation dynamics are more similar to the other two models. Furthermore, the original Lucas critique stated that a change in the systematic component of policy would have important implications for the dynamics of macroeconomic variables. This effect becomes apparent when we switch from the SW rule to the CEE rule. Under the CEE rule the policy shock has a greater effect on output. (BT)

Reference: Taylor J. & Wieland V. (2012)

Edited by Tatar B.

This exercise aims to compare the second generation DSGE models (US_SW07, US_ACELm, US_ACELswt) and the model in G7_TAY93, as these models differ in terms of economic structure and parameter estimates, which are based on U.S. data.

What to do on the MMB?

- Models: G7_TAY93, US_SW07, US_ACELm, US_ACELswt

- Policy rules: Smets & Wouters (2007), Christiano et al. (2005)

- Shocks: Monetary Policy Shock

- Variables: Inflation, Interest rate, Output, Output Gap

What is interesting?

Surprisingly, the effect of the policy shock on real output and inflation given a common policy rule is very similar in the four models. The quantitative implications for real output in G7_TAY93 and US_SW07 are also almost identical. The outcome under US_ACELm initially differs slightly from the other two models. In the period of the shock we observe a tiny increase in output, while inflation does not react at all. From the second period onwards output declines to the same extent as in the other two models but the profile is shifted roughly one period into the future. The decline in inflation is similarly delayed. Once we implement US_ACEL with the SW assumptions (US_ACELswt (2011)) of no timing constraint on policy and no cost channel, the output and inflation dynamics are more similar to the other two models. Furthermore, the original Lucas critique stated that a change in the systematic component of policy would have important implications for the dynamics of macroeconomic variables. This effect becomes apparent when we switch from the SW rule to the CEE rule. Under the CEE rule the policy shock has a greater effect on output. (BT)

Reference: Taylor J. & Wieland V. (2012)

Edited by Tatar B.

Comments

Post a Comment