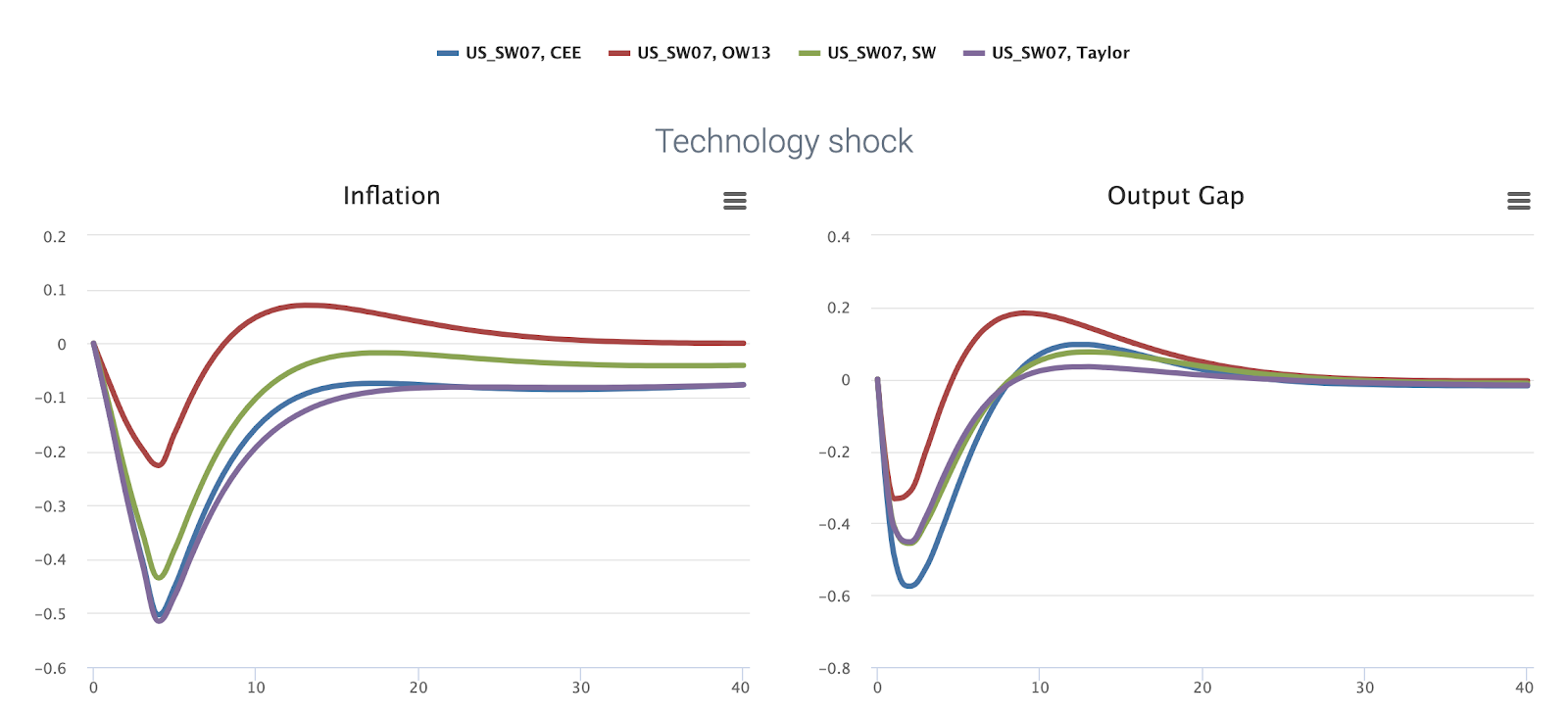

Which of the four is the most effective policy rule in a Smets-Wouters world (with financial frictions)?

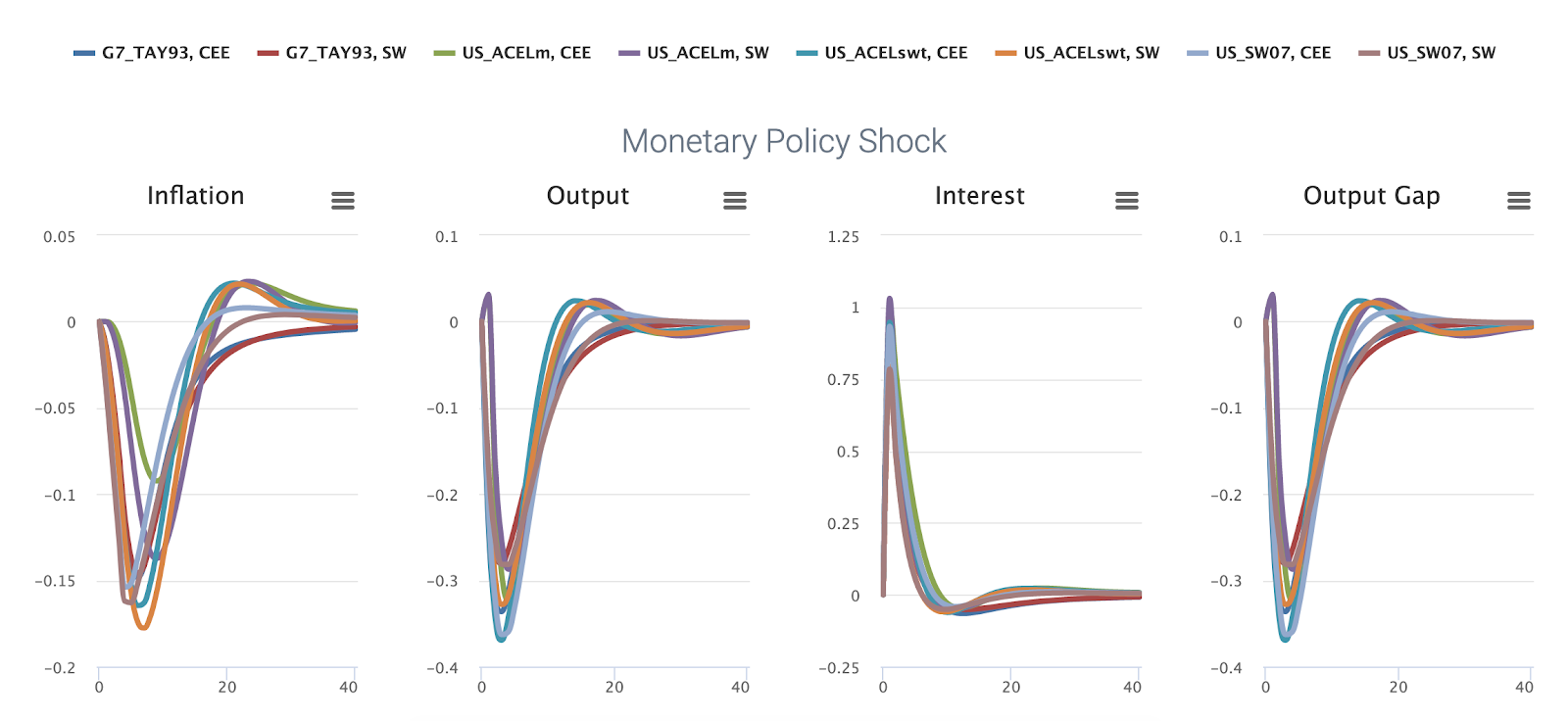

Why is it interesting? A standard recommendation is to avoid surprises in monetary policy since they only generate additional output and inflation volatility. Instead, optimal and robust monetary policy design focuses on the proper choice of the variables and the magnitude of the response coefficients in the policy rule to stabilize output and inflation in the event of shocks emanating from other sectors of the economy. In this comparison we assess how different monetary policy rules perform in two widely used estimated models describing the US economy, the US_SW07 and the US_DNGS15 models, when hit by some other than a monetary or demand shock. What to do on the MMB? This is a one model against multiple rules exercise. Please tick only one model at a time for comparison. Models: US_SW07, US_DNGS15 Policy rules: Christiano et al. (2005) rule, Orphanides and Wieland (2013), Smets and Wouters (2007), Taylor (1993) Shocks: Technology shock, Risk premium shock (for US_SW07), ...