Which of the four is the most effective policy rule in a Smets-Wouters world (with financial frictions)?

Why is it interesting?

A standard recommendation is to avoid surprises in monetary policy since they only generate additional output and inflation volatility. Instead, optimal and robust monetary policy design focuses on the proper choice of the variables and the magnitude of the response coefficients in the policy rule to stabilize output and inflation in the event of shocks emanating from other sectors of the economy. In this comparison we assess how different monetary policy rules perform in two widely used estimated models describing the US economy, the US_SW07 and the US_DNGS15 models, when hit by some other than a monetary or demand shock.

What to do on the MMB?

This is a one model against multiple rules exercise. Please tick only one model at a time for comparison.

What is interesting?

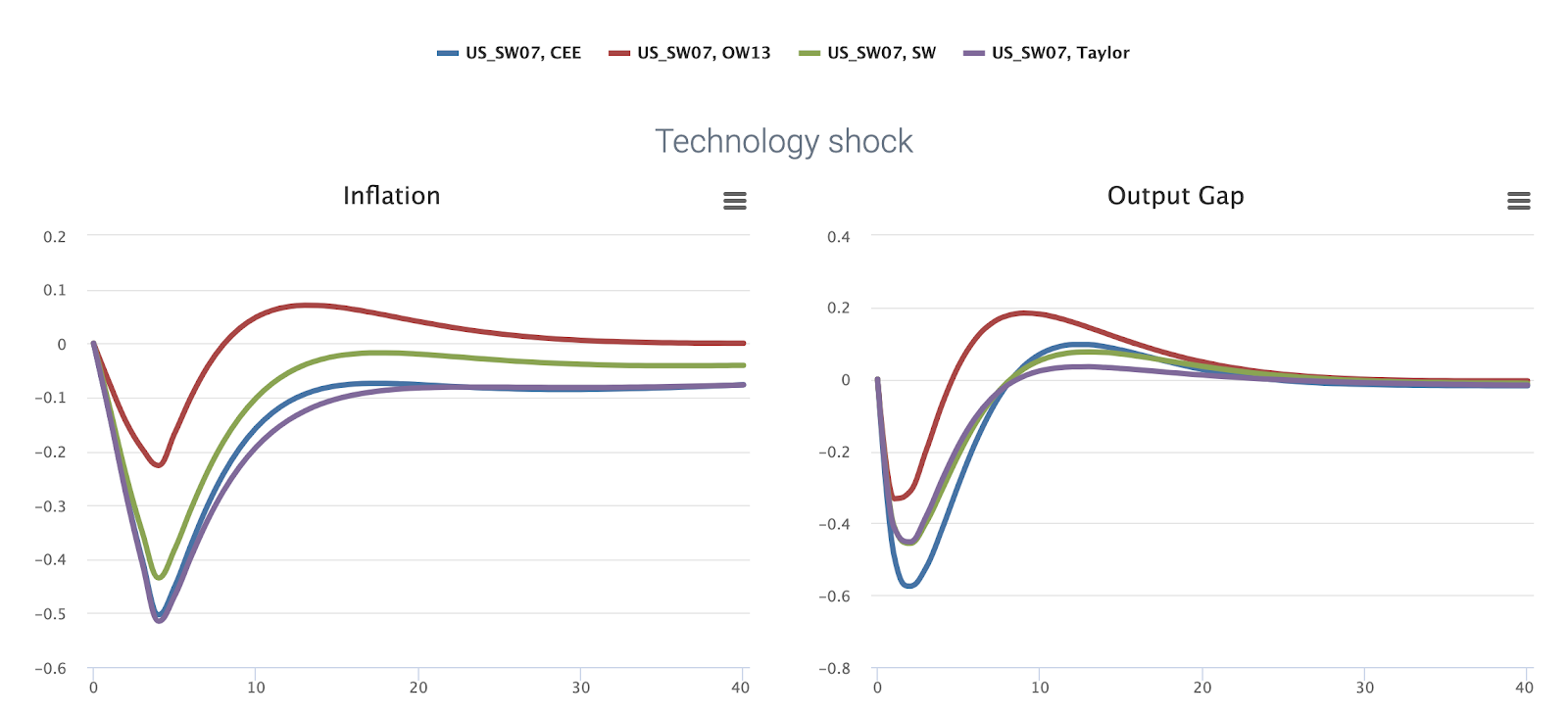

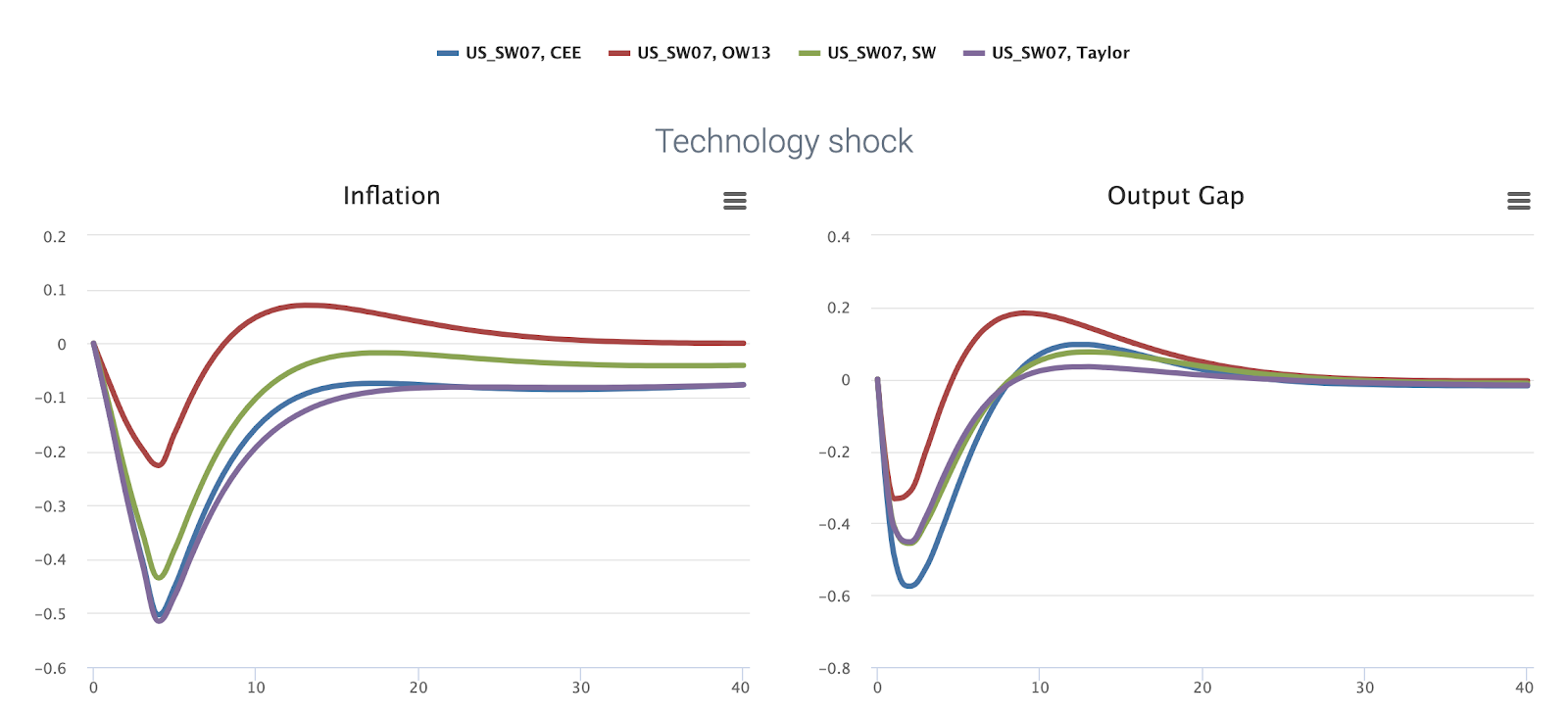

Starting with a technology shock pushing output and inflation in opposite directions, in both models the Orphanides & Wieland (2013) rule (henceforth OW13 rule), stabilizes inflation and the output gap best among the four policy rules. While all other policy rules have either no reaction to past policy rates or the weight is less than unity, the OW13 rule includes the interest rate level from the past period with full weight and is therefore also referred as the ‘first difference rule’. Interestingly, the lower reaction in inflation and the output gap does not come at the cost of a higher peak in the interest rate, yet the reaction in the output is the strongest under this policy rule. In case the economy is hit by a risk premium shock the OW13 rule controls inflation and output significantly better than any other policy rule in both models, however it comes at the cost of a higher reaction in the interest rate at its peak. As a result, regardless whether financial frictions are present in a Smets and Wouters environment, the OW13 rule remains a powerful policy tool to smooth key variables in the presence of both a technology or a risk premium shock. (This result of this comparison should also hold true if any other available policy rule is included in the comparison)

A standard recommendation is to avoid surprises in monetary policy since they only generate additional output and inflation volatility. Instead, optimal and robust monetary policy design focuses on the proper choice of the variables and the magnitude of the response coefficients in the policy rule to stabilize output and inflation in the event of shocks emanating from other sectors of the economy. In this comparison we assess how different monetary policy rules perform in two widely used estimated models describing the US economy, the US_SW07 and the US_DNGS15 models, when hit by some other than a monetary or demand shock.

What to do on the MMB?

This is a one model against multiple rules exercise. Please tick only one model at a time for comparison.

- Models: US_SW07, US_DNGS15

- Policy rules: Christiano et al. (2005) rule, Orphanides and Wieland (2013), Smets and Wouters (2007), Taylor (1993)

- Shocks: Technology shock, Risk premium shock (for US_SW07), psi_b (for US_DNGS15)

- Variables: Interest , Output, Output Gap

What is interesting?

Starting with a technology shock pushing output and inflation in opposite directions, in both models the Orphanides & Wieland (2013) rule (henceforth OW13 rule), stabilizes inflation and the output gap best among the four policy rules. While all other policy rules have either no reaction to past policy rates or the weight is less than unity, the OW13 rule includes the interest rate level from the past period with full weight and is therefore also referred as the ‘first difference rule’. Interestingly, the lower reaction in inflation and the output gap does not come at the cost of a higher peak in the interest rate, yet the reaction in the output is the strongest under this policy rule. In case the economy is hit by a risk premium shock the OW13 rule controls inflation and output significantly better than any other policy rule in both models, however it comes at the cost of a higher reaction in the interest rate at its peak. As a result, regardless whether financial frictions are present in a Smets and Wouters environment, the OW13 rule remains a powerful policy tool to smooth key variables in the presence of both a technology or a risk premium shock. (This result of this comparison should also hold true if any other available policy rule is included in the comparison)

FYI, when I attempt to reproduce this for SW07 with the new online MMB, there is no option to use the two shocks listed (Technology shock, Risk premium shock); only Monetary and Fiscal shocks appear.

ReplyDeleteRegards

Hello,

DeleteThanks for your message. Indeed, the OCP offers only two shocks (monetary and fiscal) and the four most common variables (inflation, output, output gap and interest) for comparison exercises. If you'd like to simulate other shocks, you need to download the MMB!

Best,

Chihchun

Thanks and I have a super offer: What House Renovations Need Council Approval house renovation near me

ReplyDelete